Financial services, whether it be banking, investing, or insurance, has seen massive digital transformation around self service and customer service. Ruled-based chatbots, self-service interfaces, and automation have changed the way that customers interact with your brand. However, that hasn’t changed the fact that live agent voice support is still the primary channel for high-value customer transactions.

As a result, agents are still the lifeblood of modern financial services industries. They’re your brand representatives, entrusted with driving a world-class customer experience that yields higher customer acquisition and retention rates.

So investing in impactful coaching to ensure that your agents can provide best-in-class customer experience, and at the same time, reducing risk in the wide variety of regulatory compliance risk, you’re positioning your contact center to stand out from the rest.

That’s where contact center AI comes into play.

Contact center AI: transforming financial services customer relations

Contact center AI is a technology that helps financial service organizations transform conversation outcomes by providing highly accurate speech analytics on 100% of calls and automating tedious parts of the quality management processes. With contact center AI, teams like yours can automatically surface the most meaningful areas of opportunity to better coach agents and improve processes.

By analyzing 100% of calls, you gain full visibility into what’s happening in your contact center in near real-time. From there, you can help the whole team work as one to improve agents by monitoring words and phrases; measuring all of your CX metrics from a central dashboard, such as average handle time, supervisor escalations, and customer sentiment; and identify which agents need help. Or, better yet, celebrate top performers.

In turn, analysts and supervisors can uncover insights from calls to drive more effective coaching programs and ensure compliance protocols are properly followed.

What matters most to the next-generation financial service contact center?

Customer Experience

Your desired business outcomes revolve around delivering a positive customer experience to everyone who calls in. As a result, you need to know what’s causing customer frustrations and unmet needs. Or vice versa -- what interactions are driving the experience and outcomes you want, such as customer acquisition and retention.

Business Insights

There’s a treasure trove of business insights in every call, so uncovering and reporting on those insights is critical. This is where you can discover call drivers (why customers are calling in), why customers are churning, and overall trends that may be impacting your business.

Customer acquisition and retention

Bringing in new customers and retaining your existing customer base is your most important business metric. The interaction types that impact acquisition and retention - agent/customer rapport, agent efficiency, operational efficiency, compliance, and more all play a big role in driving those outcomes. You need to be able to identify those interactions while constantly - and rapidly - improving them.

5 strategies to achieve (or better yet, over deliver on) your KPIs

Improve Conversion and Retention Rates

Acquiring new customers and retaining their business are two of the most critical metrics you're solving for. Your agents are responsible for providing that great experience to hit those goals. With contact center AI, identify key phrases used across calls at key times. This will help you more deeply understand your customer journey, monitor the more impactful talk tracks, and discover trends on the most requested products and services.

Consider your core sales script as an example. By capturing deep insights into 100% of customer conversations, you can understand exactly where customers churn, what dialogues they receive positively, and what is impacting agent effectiveness.

- Uncover Root Causes of Inefficiencies: Identify inefficiencies (whether they’re in or out of an agent’s control), and rapidly course-correct. For example, if there are extended periods of Dead Air on a call, quality analysts can better understand why that Dead Air is occurring and mitigate it. Dead Air can signify that agents are unsure of how to respond.

- 5x Faster Evaluations: With evaluation forms built directly into the platform, everything your QAs and supervisors need -- from call transcripts, to evaluation and coaching forms, an agent leaderboard, and more is available at their fingertips.

- Rapid Feedback & Coaching Tips: By leveraging machine learning to flag coaching opportunities, supervisors and team leads can quickly share feedback with agents. Leave coaching tips directly in a time-stamped transcript, such as “next time, try this..” or bring a small group of agents into a huddle to do a Zoom side-by-side to improve their customer interactions in a personalized way.

Increase Customer Satisfaction

Your agents are your frontline representatives. Enabling them to crush their KPIs starts with monitoring 100% of interactions for customer sentiment and experience insights. From there, you can create more targeted agent enablement programs built with context around why and how to improve metrics like CSAT and NPS scores.

With 100% call coverage, you can also understand the customer journey from end-to-end, empowering you to uncover new ways to better personalize your service. You’ll find trends that’ll allow you to act proactively, rather than reactively, on delivering a better customer experience.

Try monitoring these metrics:

- Monitor for Supervisor Escalations: Discover why callers are escalating calls to supervisors, and train your team on de-escalation techniques, or enable them with new resources if it’s out of their control.

- Monitor for Empathy Statements: Validate if agents are establishing a connection with customers and coach them on how and when to use empathy statements.

- Gauge the Sentiment of Key Interactions: With tonality-based sentiment analysis, understand how the customer is feeling throughout the call to dig deeper into what is driving positive or negative customer experience outcomes. This also helps you identify and monitor agent soft skills which are critical traits for improving CSAT.

Reduce Operational Costs

Providing live support is expensive. As a result, focusing on monitoring agent efficiency metrics based around resolving the call quickly and on the first attempt is key to reducing operational costs.

Success lies in uncovering root causes of operational inefficiency, knowing what self-service solutions could solve simple problems at scale, and identifying where self-service falls short.

- Reduce Average Handle Time (AHT): Identify what exact interaction types are causing agents to get stuck and guide micro-training sessions to quickly mitigate problems.

- Improve First Call Resolution (FCR): Uncover what moments within conversations are impacting first call resolution, like supervisor escalations, and hold training sessions on how to reduce those instances.

- Increase Average Speed of Answer (ASA): Know exactly what information gaps are affecting agent speed to answer and update training materials, such as internal knowledge bases.

Mitigate Regulatory Compliance Risk

With constantly evolving regulations and legislature, you must be ahead of the game when it comes to compliance, especially in an industry as heavily regulated as financial services. It begs the question, how do you ensure compliance while providing a world-class customer experience?

That starts with monitoring every conversation that takes place, not just a random sampling of just 1-2% of calls. Coverage is key in compliance mitigation - you simply can’t allow anything to slip through the cracks. Critical compliance metrics include:

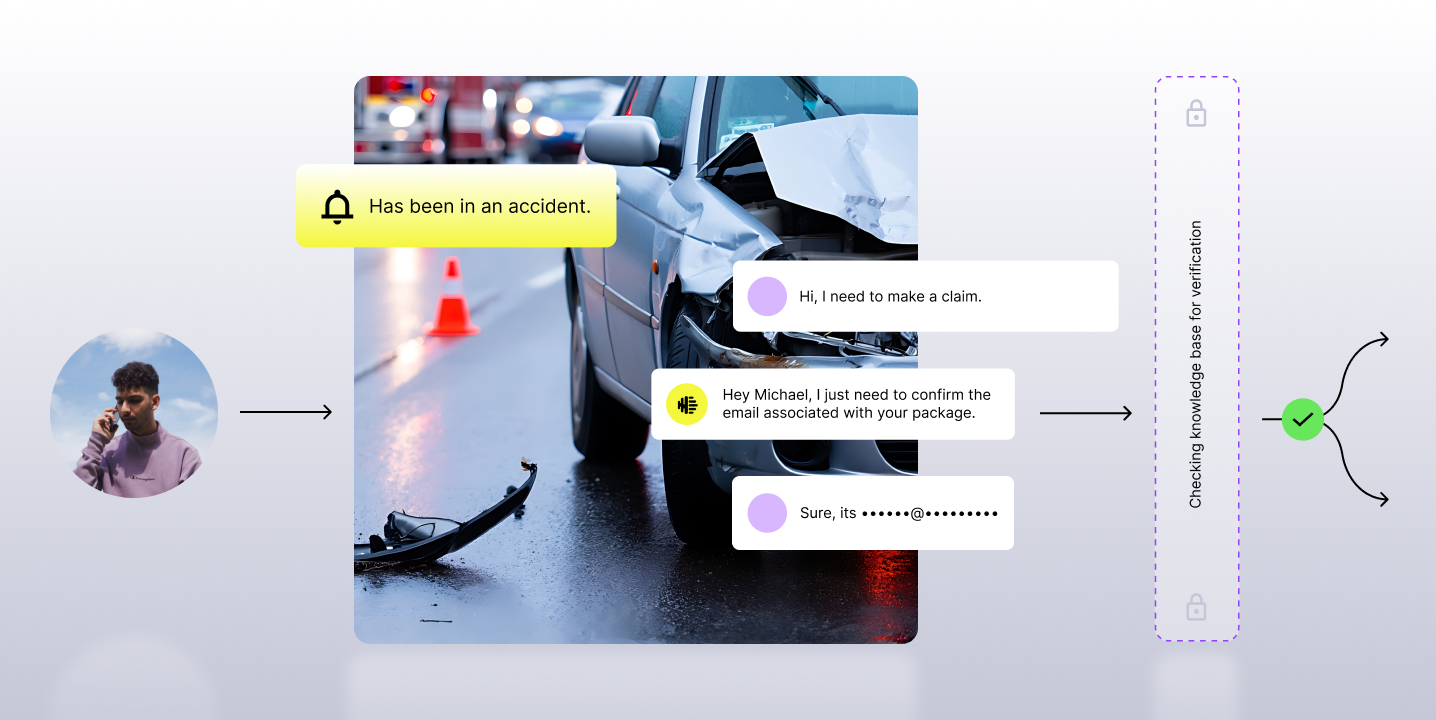

- Monitor Mandatory Disclosures on 100% of Calls: Monitor and confirm whether dialogues like customer verification are being made by agents and quickly correct agents who are not reciting the proper disclosures.

- Proactively Tailor Compliance Training: Create ongoing compliance training for specialists around both new regulations and identify compliance risks with data.

- Protect Consumer Information with PII Redaction: Automatically redact and protect sensitive consumer information on call recordings and transcripts, ensuring that PII is masked.

Deeper Intelligence Means Better Business Decisions

With valuable information in every voice call, analyzing, aggregating and disseminating business insights across the entire organization drives better business decisions. It’s key to creating a culture of transparency, trust, and collaboration, and minimizes team friction, helping teams work as one.

Understanding how customers are responding to a new product line helps marketing deliver stronger campaigns. Uncovering major pain points and unmet customer needs helps calibrate product management's roadmap.

Discovering the good and bad moments leading to conversions and churn helps sales better enable their agents to close more business. These are the key business insights surfaced from every call, impacting every function of the business.

- Uncover Marketing Opportunities: Keep a finger on the pulse for how customers are responding to marketing campaigns, and surface ideas for new ones.

- Improve Sales and Support Messaging: Understand what interactions are leading to positive and negative results, and create targeted, data-backed training around it.

- Deliver Product Feedback: Customers are an untapped source of product feedback, and by monitoring their feelings around certain products and services, that feedback can be sent back to product to influence roadmap decisions.

Wrapping Up

We've spoken to dozens of financial services organizations looking for new ways to improve their agent performance, mitigate compliance risk, and provide a world-class customer experience on every call they field.

One story in particular we love to tell is Root Insurance's, who, while experiencing rapid growth in their team and monthly interactions, took the guesswork out of their quality programs through the power of contact center AI. As their Compliance Manager Kyle Kizer put it:

“Success for our team means bringing out the best in each agent. We’re able to do that by throwing out the one size fits all coaching approach and tailoring conversations on an individual basis. Contact center AI helps ensure you’re an optimized leader by identifying and addressing the right gaps.”