AI FOR BANKING & FINANCIAL SERVICES

Reduce Customer Friction While Meeting Complicance

Observe.AI gives financial institutions the visibility and control they need to improve agent performance, automate routine workflows, and proactively reduce compliance risk.

Here’s how banking and financial services clients use Observe.AI

24/7 white-glove service

Fully automate your high-volume, complex customer interactions with personable, secure, and easy-to-integrate AI agents that understand and solve your customers’ financial needs in 25+ languages and dialects.

- Account and technical support

- Payment and transaction assistance

- Loan servicing

- FAQs

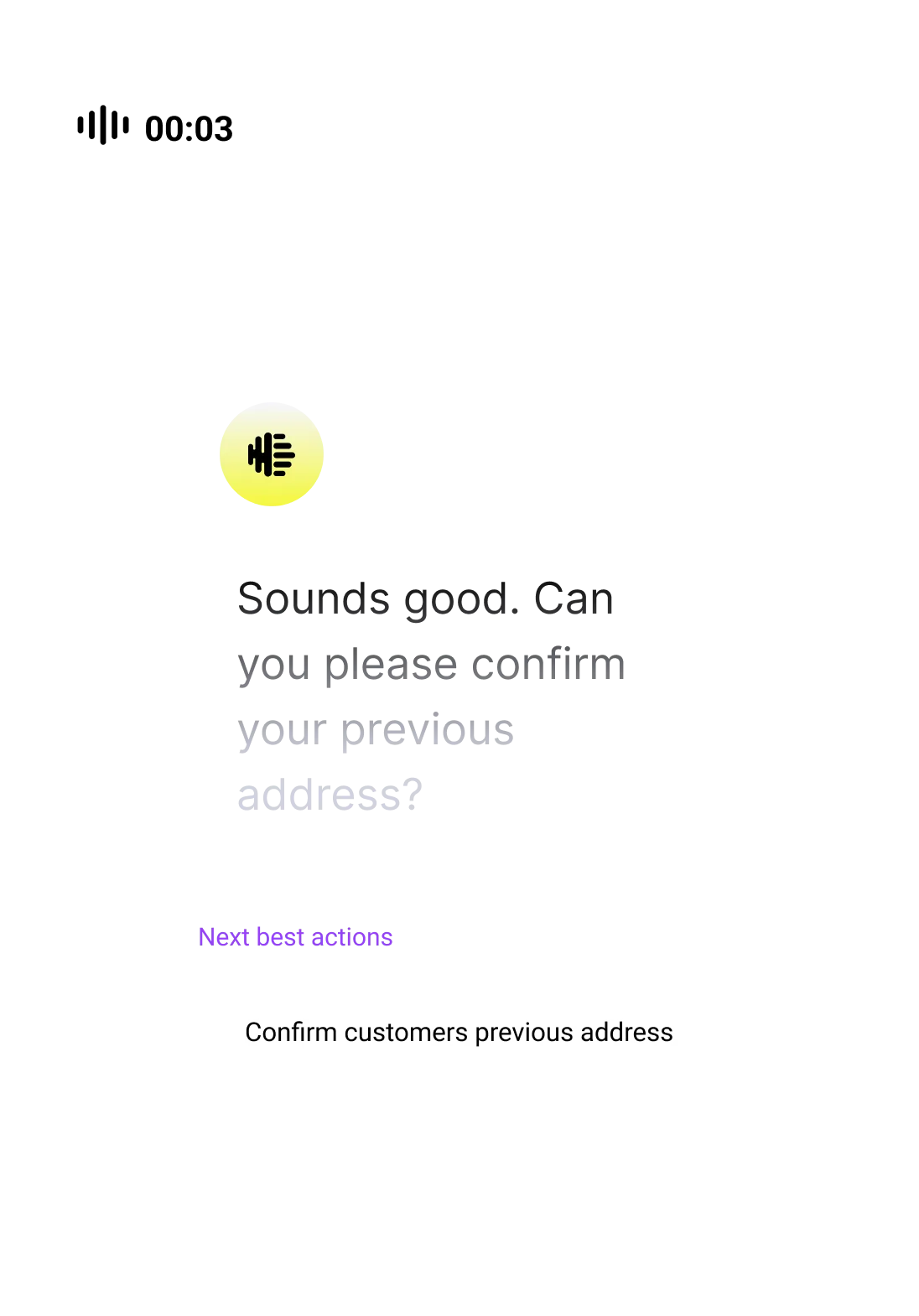

Copilot for your team

Empower your brokers, agents, advisors, and representatives to deliver exceptional performance by giving them an AI Copilot that delivers proactive alerts, in-conversation nudges, and suggested next-best-actions.

- Product recommendations

- Promise to pay outreach

- Loan qualification

- Caller authentication

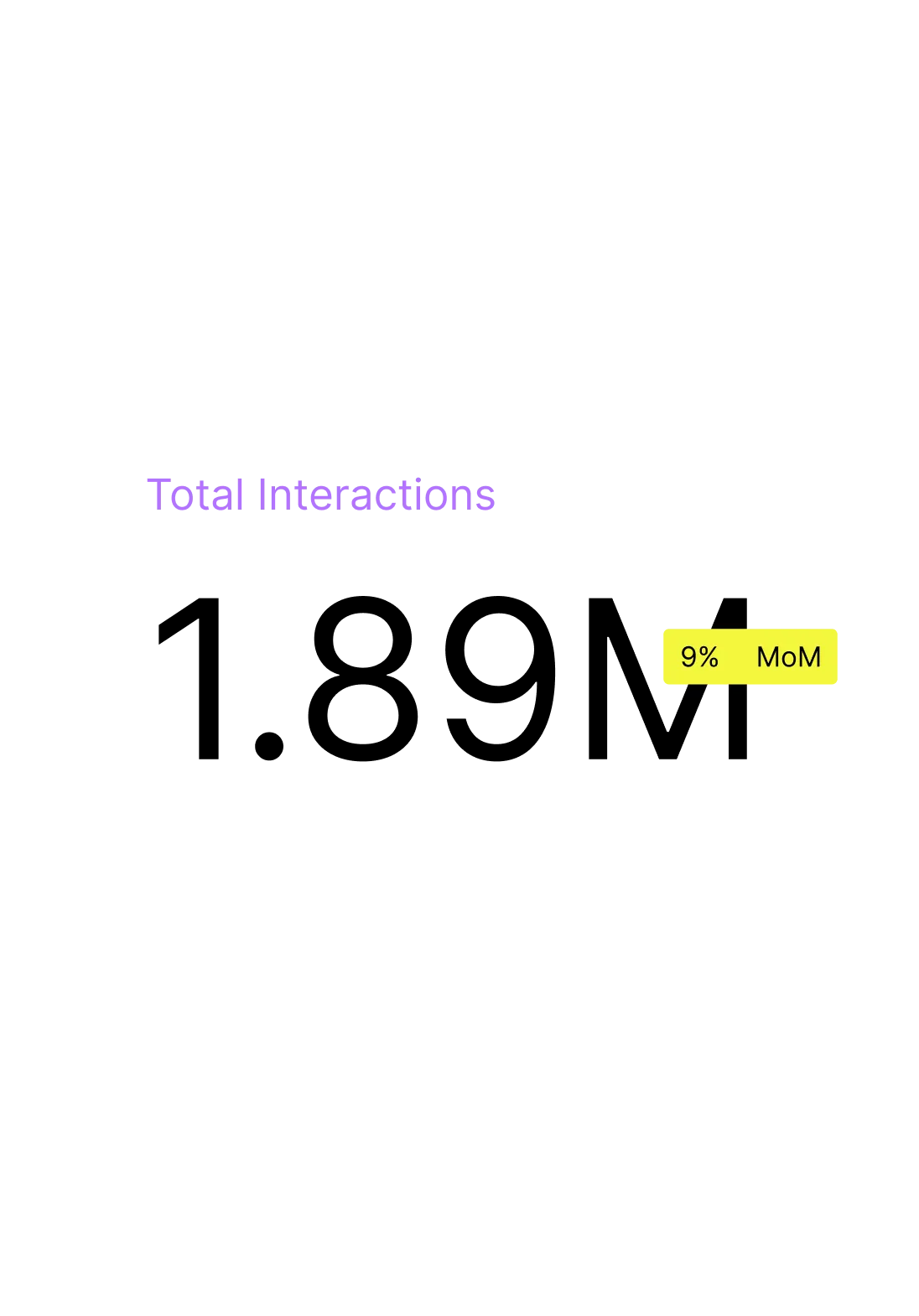

Business driver visibility

Learn from 100% of your customer interactions—improve every agent, every moment, and every decision that moves your business forward.

- Outreach reasons

- Hardship trends

- Winning promise-to-pay tactics

- Product ideas and improvements

Seamless integration with your BFS systems

Connect your AI Agents to the tools your teams already use

View all integrations

Why banking and financial services enterprises prefer Observe.AI

01

01

Trusted Partner

As experts in customer experience with a deep understanding of human-to-human conversations, we work with you to identify more opportunities to seamlessly integrate AI Agents into your organization to address immediate needs with measurable results and drive long-term success.

02

02

Agentic Architecture

Easily create sophisticated AI agents that reflect your brand personality using natural language prompts. Your agents will accurately follow your processes and can take action by connecting with 250+ business systems.

03

03

AI Agent Trust

With a long history of successfully delivering conversation intelligence solutions for highly regulated industries, we have adopted rigorous quality assurance to effectively monitor and measure every AI Agent interaction for quality, compliance, and trust. Drill down reporting, alerting, simulations, and fallbacks give you the ability to deploy and scale with confidence.

04

04

Continuous Learning Loop

By continuously exposing AI Agents to real-world simulations and your actual call interactions, your agents will continue to learn and evolve with your business.

Real results from actual customers

Read to invest?

Our AI Agents deliver more value across retail banking, investment and health management, lending and mortgages, fintech and digital payments, and tax services.

FAQ

Observe.AI helps financial institutions automate high-volume customer interactions, deliver 24/7 support, and improve agent performance through secure, compliant AI. Its AI Agents handle tasks like loan servicing, payment assistance, and account updates, while AI-powered guidance helps brokers, advisors, and service teams resolve issues faster and more accurately.

Yes. Observe.AI is designed for highly regulated environments and supports workflows that require secure authentication, consistent communication standards, and accurate execution. Its AI ensures sensitive interactions—such as payments, loan discussions, and account modifications—follow compliance-ready processes that reduce errors and support auditability.

AI Agents can automate a wide range of banking and financial service interactions, including loan servicing, account and technical support, payment inquiries, transaction assistance, and general customer FAQs. They provide secure, multilingual support and integrate easily into existing systems to help teams scale service without compromising accuracy.

Observe.AI enhances collections operations by analyzing customer conversations to identify hardship trends, highlight effective promise-to-pay strategies, and pinpoint coaching opportunities for agents. AI guidance and automation help teams deliver more empathetic, compliant outreach and increase repayment success rates.

Yes. By automating high-volume service interactions and improving agent effectiveness, Observe.AI helps reduce cost-to-serve while maintaining high service quality. Financial institutions leveraging AI Agents and automation workflows have achieved significant savings, along with measurable gains in compliance, first-contact resolution, and customer satisfaction.