Agents are the lifeblood of a collections agency. Every consumer interaction must be approached with integrity, respect, and professionalism - the cornerstone values of all successful collections organizations.

Equally critical is compliance. In one of the most regulated industries today, ensuring mandatory compliance regulations are followed 100% of the time can make or break your business.

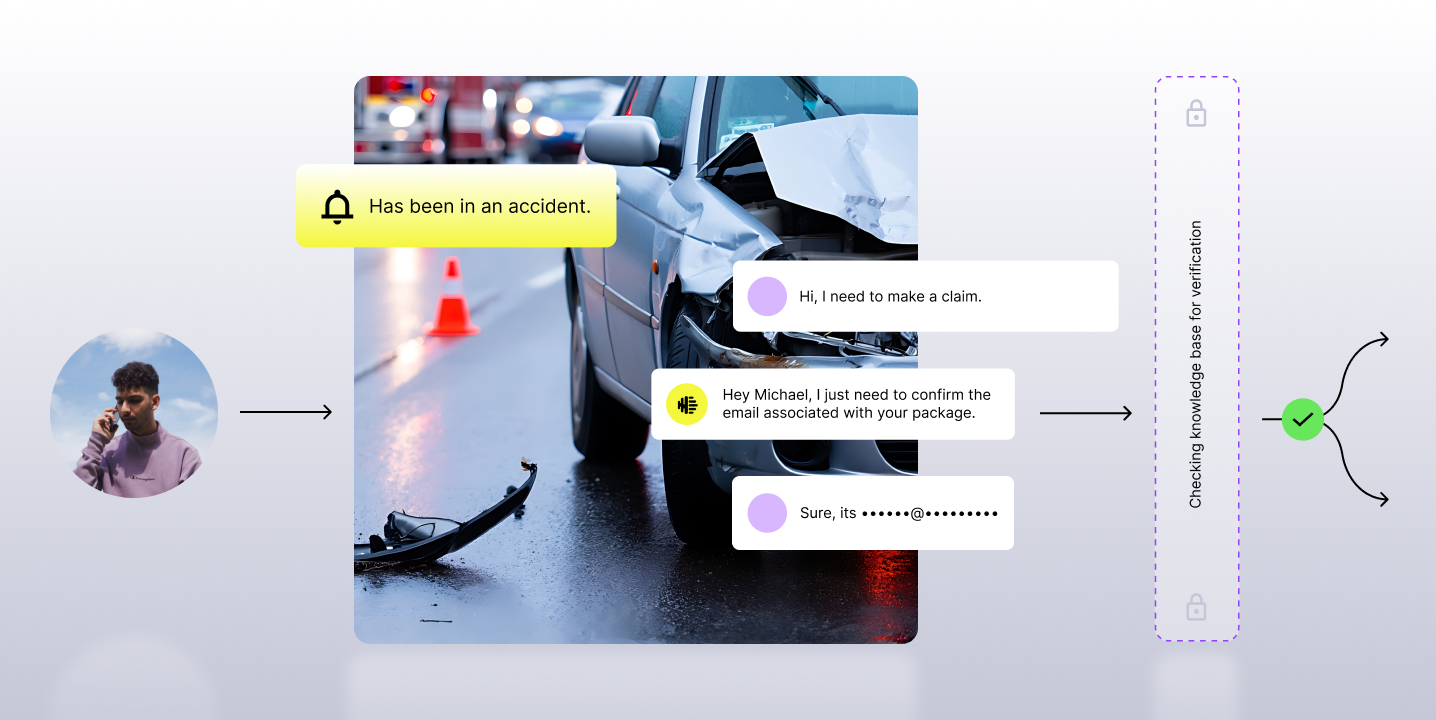

So how do you improve collection rates, enable your agents, and reduce compliance risk? That's where contact center AI comes into play.

Contact center AI and collections, a perfect match

Contact center AI is a technology that helps collections companies transform conversation outcomes by providing highly accurate speech-to-text on 100% of calls and automating the quality management processes.

With contact center AI, teams like yours can automatically surface the most meaningful areas of opportunity to better coach agents and improve processes.

By analyzing 100% of outbound calls, you gain full visibility into what’s happening in your contact center. From there, you can help the whole team work as one to improve agents by:

- Monitoring words and phrases

- Measuring all of your CX metrics from a central dashboard, such as dead air, hold time, and consumer sentiment

- Identifying which agents need help

- Building tailored, adaptive training programs

In turn, analysts can uncover insights from calls to drive more effective coaching programs and ensure compliance protocols are properly followed.

Crush the KPIs that matter most

Drive higher collection rates

There’s a treasure trove of data on every call, and when it comes to improving your most critical KPI, collection rates, you need to uncover that data. That starts with a deep understanding of the phrases, the behaviors, and the sentiment that make you successful.

- Leaderboards: Leaderboards help to understand who your top performers are, and surface those insights to drive targeted, impactful training for those who need improvement.

- Moments: Discover the keywords and phrases that lead to positive customer experiences or areas where you can improve.

- Keyword Phrase Monitoring: Uncover inefficiencies affecting collection rates, such as agents not asking for how the consumer would like to settle the debt.

Establish better agent/consumer rapport

Sensitivity and empathy are crucial traits of a successful collections specialist. You need to ensure that agents are treating consumers the right way in order to collect their balance.

- Monitor for Empathy Statements: Validate if agents are establishing a connection with customers and coach them on how and when to use empathy statements.

- Gauge the Sentiment of the Interactions: With tonality-based sentiment analysis, understand how the consumer is feeling throughout the call to dig deeper into what is driving positive or negative customer experience outcomes.

Optimize agent productivity

Building processes around driving agent consistency and efficiency leads to more conversations, and in turn, higher collection rates. Rapid performance feedback is what fuels agent engagement.

- Uncover Root Causes of Inefficiencies: Identify inefficiencies (whether they’re in or out of an agent’s control), and rapidly course-correct. For example, if there are extended periods of Dead Air on a call, quality analysts can better understand why that Dead Air is occurring and mitigate it.

- Rapid Recommendations: With deep insights on 100% for every agent, supervisors and managers can quickly identify gaps in agent performance and mitigate them with micro-coaching sessions.

Mitigate compliance risk

With constantly evolving regulations and legislature, Collections is one of the most regulated industries today. It begs the question, how do you ensure compliance while maintaining high collection rates?

- Monitor ‘Mini-Miranda’ Disclosures on 100% of Calls: Informing the consumer that the call is from a debt collector is a key piece of collections compliance. Monitor and confirm whether mini-Miranda and other disclosures are being made by collection specialists, and quickly identify and correct agents not reciting the disclosure.

- Proactively Tailor Compliance Training: Create ongoing compliance training for specialists around both new regulations, as well as compliance risk at the organization level, backed by data.

- Protect Consumer Information with PII Redaction: Automated redaction protects sensitive consumer information on call recordings and transcripts, ensuring that PII is masked.

So, do you need contact center AI?

In collections, data drives the decision-making process. Insights on 100% of your collections calls is what drives better business decisions. And with deep reporting on KPIs across performance, compliance, and CX, this data breaks silos between departments and delivers valuable insights - from QA to marketing and beyond.

Ask yourself the questions below. Are these important to you, and do you think you could improve on them?

Compliance

- Am I proactively mitigating compliance risk?

- Am I protecting consumer data?

QA

- Am I evaluating performance in a fair and transparent way?

- Am I effectively evaluating enough calls per agent?

Training and Coaching

- Am I training collections specialists on the right topics?

- Am I being effective?

Leaders and Operators

- Am I creating a culture of transparency and trust?

- Am I using CX and performance insights to drive business decisions?